Navigating insurance coverage for therapy can feel like a tricky maze with no clear way out of. It’s easy to feel overwhelmed, especially when it comes to understanding out-of-network (OON) benefits. Many people don’t realize that they can still work with a therapist who doesn’t accept their insurance directly—and get reimbursed for some or all of the costs. This guide discusses how to use Out-of-Network benefits coverage to help you access a therapist who specializes in your needs. We will define the key terms, processes, and benefits of using OON coverage for therapy, so you can feel informed and confident about your options.

A Note of Caution:

Insurance plans vary, so it’s essential to contact your insurer for details specific to your coverage. This guide is meant to provide general information, but you’ll need to consult with your insurer to understand your unique plan.

A Second Note of Caution:

This guide was written while the Affordable Care Act (ACA) is in place. Should the ACA be repealed or changed, it may change the information related to this guide.

Insurance Basics: How Coverage Works for Therapy

Does Insurance Pay for Therapy?

Yes, most insurance companies will cover therapy if it’s considered “medically necessary.” Medical Necessity means you have a diagnosed condition from a licensed provider and you have a treatment plan designed to address that diagnosis.

Under the Affordable Care Act (ACA), mental health services are considered an essential benefit, and therefore ensures coverage if it meets criteria for medical necessity. However, the specifics of your plan may determine if you can only see an in-network therapist, or if out-of-network therapists are also covered.

In-Network vs. Out-of-Network: What’s the Difference?

- In-Network (INN): These are providers who are contracted with your insurance company. The fee for therapy is a pre-set amount determined by your insurance company, and you are responsible for any payment up to your deductible, or copay/co-insurance, while the insurance covers the rest – the specifics of your deductible and co-pay/co-insurance are specific to your insurance coverage, so you would have to contact them for more information. The downside? These therapists must follow the insurance company’s rules regarding session length, type of therapy, and how many sessions are covered. Also, therapists must apply to be INN with an insurance company, so it limits who you get to see based on this.

- Out-of-Network (OON): These are licensed therapists who don’t contract with insurance companies. These therapists set their own fees and you pay them directly for their services. They can then provide you with a detailed receipt (called a superbill). You can then file a claim with your insurance for potential reimbursement, the specifics of which are specific to your insurance plan. The benefits of this is that you have more control over who you get to see, what happens in therapy, and how often/how long you see them for.

What Are HMO, PPO, and POS Plans?

Your type of insurance plan determines your flexibility in choosing a provider.

- HMO (Health Maintenance Organization): You’re required to see in-network providers and often need referrals for specialists. HMOs typically do not cover OON services.

- PPO (Preferred Provider Organization): Offers the flexibility to see OON providers. You’ll pay upfront and can submit claims for partial reimbursement.

- POS (Point of Service): A hybrid plan combining features of HMO and PPO plans, sometimes offering limited OON coverage.

Key Insurance Terms You Need to Know

- Medical Necessity: For insurance to cover any service, it must be deemed “medically necessary”; the exact criteria of medical necessity changes plan-by-plan. But generally, this means that a person has been diagnosed with a mental health condition by a licensed therapist, and also has a treatment plan in place to specifically address said mental health diagnosis.

- Premium: The monthly fee you pay to maintain your insurance coverage.

- Deductible: The amount you pay out of pocket before insurance begins covering costs. Some plans have separate deductibles for INN and OON services.

- Cost-Sharing: Once you have met your deductible, you may be responsible for a portion of your bill. The amount you pay is either:

- Co-pay: A flat fee you pay per visit once your deductible is met.

- Co-insurance: A percentage of the bill you pay after meeting your deductible. For example, if your co-insurance is 20%, you’ll pay $100 on a $500 bill.

- Out-of-Pocket Maximum: The total amount you’re responsible for in a year. This includes your deductible and cost-sharing contributions. After reaching this, insurance covers 100% of medically necessary costs.

- Superbill: A receipt your OON therapist provides, containing all the information needed to submit a claim to your insurance.

Why Choose an Out-of-Network Provider?

Specialized Care:

OON providers often specialize in areas like trauma, eating disorders, or OCD, offering expertise not always available in-network.

Personalized Treatment:

Without insurance constraints, you and your therapist can design a treatment plan tailored to your needs, including session length and therapy type.

Shorter Wait Times:

In-network therapists often have long waitlists. OON therapists may offer faster access to care.

No Diagnosis Required:

While insurance demands a diagnosis for coverage, OON therapists can see you regardless of whether you meet diagnostic criteria.

Control Over Your Healthcare Decisions:

You get to decide the type of therapy you access, who you work with, and how long you work with them for. OON therapy allows you to have full say over your therapy and your care.

How to Use Out-of-Network Benefits for Therapy

- Ask Your Insurer About OON Coverage:

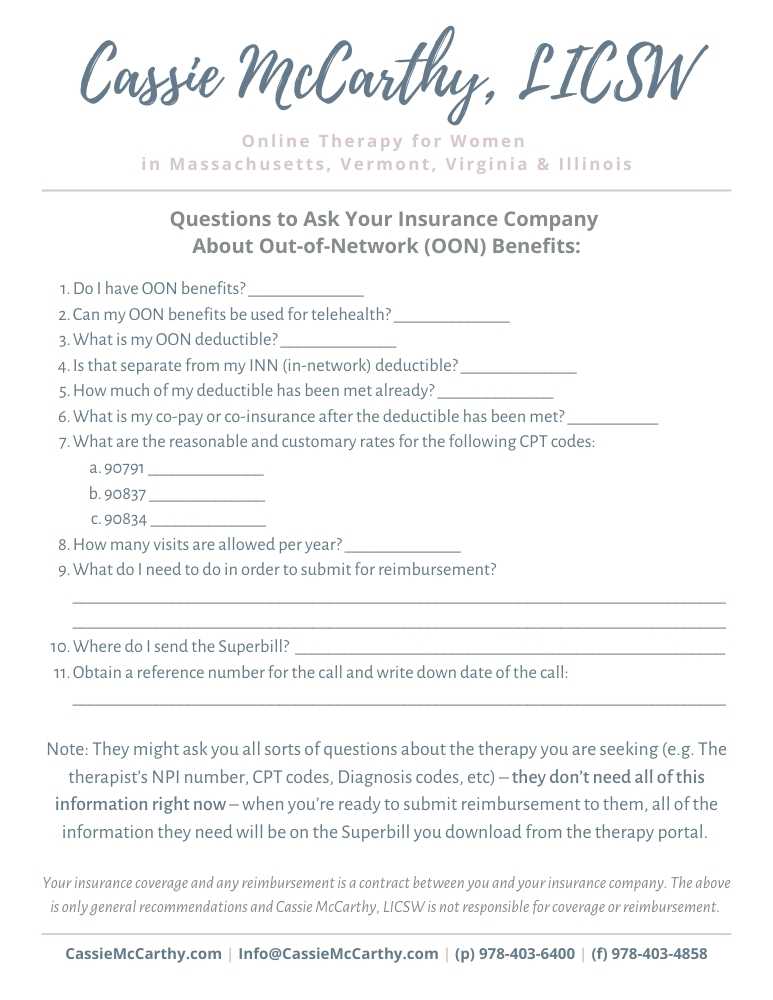

Use your insurance card to find the customer service number. Ask the following questions: - Do I have OON benefits for therapy?

- What is my OON deductible, and how much of it have I met?

- What percentage of the session fee will I be reimbursed?

- Are there any session limits?

- What documentation do I need to submit a claim?

- Pay Your Therapist Directly:

OON therapists typically require payment at the time of service. - Obtain a Superbill:

Ask your therapist for a superbill, which includes: - Your therapist’s name, license, and NPI number.

- Diagnosis and treatment codes.

- Session dates and costs.

- Submit Your Claim:

Follow your insurer’s claim process. Many have online portals for uploading superbills. - Receive Reimbursement:

Reimbursement amounts vary based on your plan. For instance, if your insurance allows $100 for therapy and covers 70%, you’ll receive $70—even if your therapist charges $150.

Common Questions About OON Coverage

What if My Claim Is Denied?

Contact your insurer for an explanation and details on their appeals process. Sometimes, additional documentation from your therapist can help.

Do I Have Separate Deductibles for INN and OON Services?

Many plans do. For example, your in-network deductible might be $500, while your OON deductible is $1,500.

How Long Does Reimbursement Take?

Processing times vary by insurer, typically ranging from a few weeks to a month.

Cost Considerations for Out-of-Network Therapy

How Much Will I Be Reimbursed?

Insurance companies determine a maximum “allowed amount” for therapy. They’ll reimburse a percentage of this amount, not your therapist’s full fee. So, for example, if your therapist charges $200 for a session, but your insurer indicates the maximum allowed amount is $120 but they only cover 80% of that, your insurer will reimburse you $96.00 per session. Some insurance plans cover more, some cover less; this is plan-by-plan specific so be sure to learn the details of your coverage from your insurer.

Can I Use HSA or FSA Funds for Therapy?

Yes, most OON therapists accept payment through Health Savings Accounts (HSA) or Flexible Spending Accounts (FSA). These accounts use pre-tax dollars, making therapy more affordable.

Benefits of OON Therapy

- Higher Quality Care:

OON therapists aren’t restricted by insurance policies, allowing them to provide comprehensive and specialized treatment. Furthermore, they are oftentimes more specialized in their field and can offer more in-depth services. - Freedom to Choose Your Therapist:

You’re not limited to a directory of in-network providers, giving you access to someone who truly fits your needs. - More Time in Session:

Without insurance dictating session lengths, many OON therapists offer extended or flexible session times.

Conclusion: Take Charge of Your Therapy Journey

Understanding out-of-network benefits empowers you to access high-quality, personalized care without being constrained by insurance networks. While it requires extra steps to submit claims, the benefits of working with an OON provider—like specialized care, shorter wait times, and greater flexibility—are well worth it. If you’re considering therapy with an out-of-network provider, reach out to your insurer and your prospective therapist to ensure you’re clear on your options.

Ready to prioritize your mental health?

If you live in Massachusetts, Vermont, Virginia, Florida, or Illinois, I’d be honored to support you on your journey. Let’s connect and discuss how therapy can help you build a life of healing and empowerment. Contact me today for a free consultation